In this episode, Fadhel Kaboub from Denison University joins us to talk about monetary sovereignty (or lack thereof) in formerly colonized countries.

Highlights

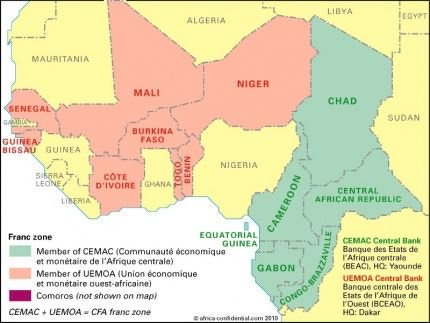

France and the CFA

On December 26, 1945, to the official creation of the Franc of the French Colonies in Africa (FCFA) in their 15 colonies. As we have covered before, France bullied these colonies into agreeing to continue to the CFA, after “independence”

France forced these 14 African into a treaty where they must put: 65% of their foreign currency reserves into the French Treasury and another 20% to "repay" France for their benevolent colonialism. The CFA countries only ever have access to 15% of their own money! And if they want to borrow money, they need to borrow it from private French Bankers at Commercial rates.

Most of these countries are mineral rich. Under the, “Treaty for Independence",France gets the right of first refusal for any mineral contract. Only if France says they don’t want to extract resources, these countries can make contracts with others to mine.

Why don't these colonies break the treaties?

Well, France has thought of that too. Within the treaty, France has an exclusive contract to sell weapons and also train the military in the former colonies.

The treaties also give France the authority to "pre-deploy" French troops for "peace-keeping" purposes. This means that if a country’s leader tried to get out of this, well, the French pre-deployed troops can force a coup at anytime!

Trade Deficits

Food Sovereignty

Most colonies were designed to produce one crop and they would import their food needs because they were not treated like a country with citizens but an area for capital exploitation. After world war II, Europe made sure that it was food sovereign, but these colonies have to import food from Europe.

Energy Sovereignty

Importing energy is a one way import. This creates an imbalance too!

Imbalance of Value-Added imports

African countries export raw minerals. These minerals get processed abroad and then get reimported back as cellphones, tvs etc. Since Africa isn’t allowed to develop its own industries, the goods they import cost much more than the goods they export. This creates a trade deficit. When the trade deficit gets big enough, we get big structural adjustments from the IMF.

Structural Adjustments

Eventually, these developing countries lose their sovereignty when the trade deficits get too high, the IMF steps in and imposes conditions, which usually make things worse for the developing countries. This is the bulk of the episode!

Fadheel Khaboub can be found on twitter. His progressive policy think-tank: Global Institute for Sustainable Prosperity works on creating a fairer and more just world by working with countries on monetary sovereignty.