The Liberty Bonds: The Seeds of the 1929 Crash

Woodrow Wilson's idea of liberty bonds seeded the beginnings of the crash

When the US joined World War I, Woodrow Wilson's government was rightfully concerned about extreme inflation from the war. During the war, the government floods the country with currency to procure weapons and supplies for the war effort. In World War I, a significant number of soldiers were sent abroad, thereby eliminating their participation in the economy, resulting in more cash distributed among fewer people, and in an uncontrolled economy, this creates inflation.

To stop the oversupply off the currency, the government created liberty bonds as a way of de-circulating some of the currency. Unfortunately, to get ordinary Americans to buy these bonds, President Wilson's government engaged in one of the most aggressive advertising campaigns.

They advertised in over 3200 cities urging people to invest in liberty bonds as their patriotic duty. These posters were blasted all around the city. They even had radio campaigns and celebrities like Charlie Chaplin urging people to buy these liberty bonds. Here is a silent movie starring Charlie Chaplin urging people to buy Liberty Bonds

They even had Liberty Bond rallies!

The Mechanics

The lowest possible denominator for the liberty bond was $50. But, to make it accessible to the average worker, the government offered an installment plan. In 1917, the average factory worker made ¢32 per hour. Full-time-work was defined as 54 hours; they would need three weeks worth of salary to afford a liberty bond.

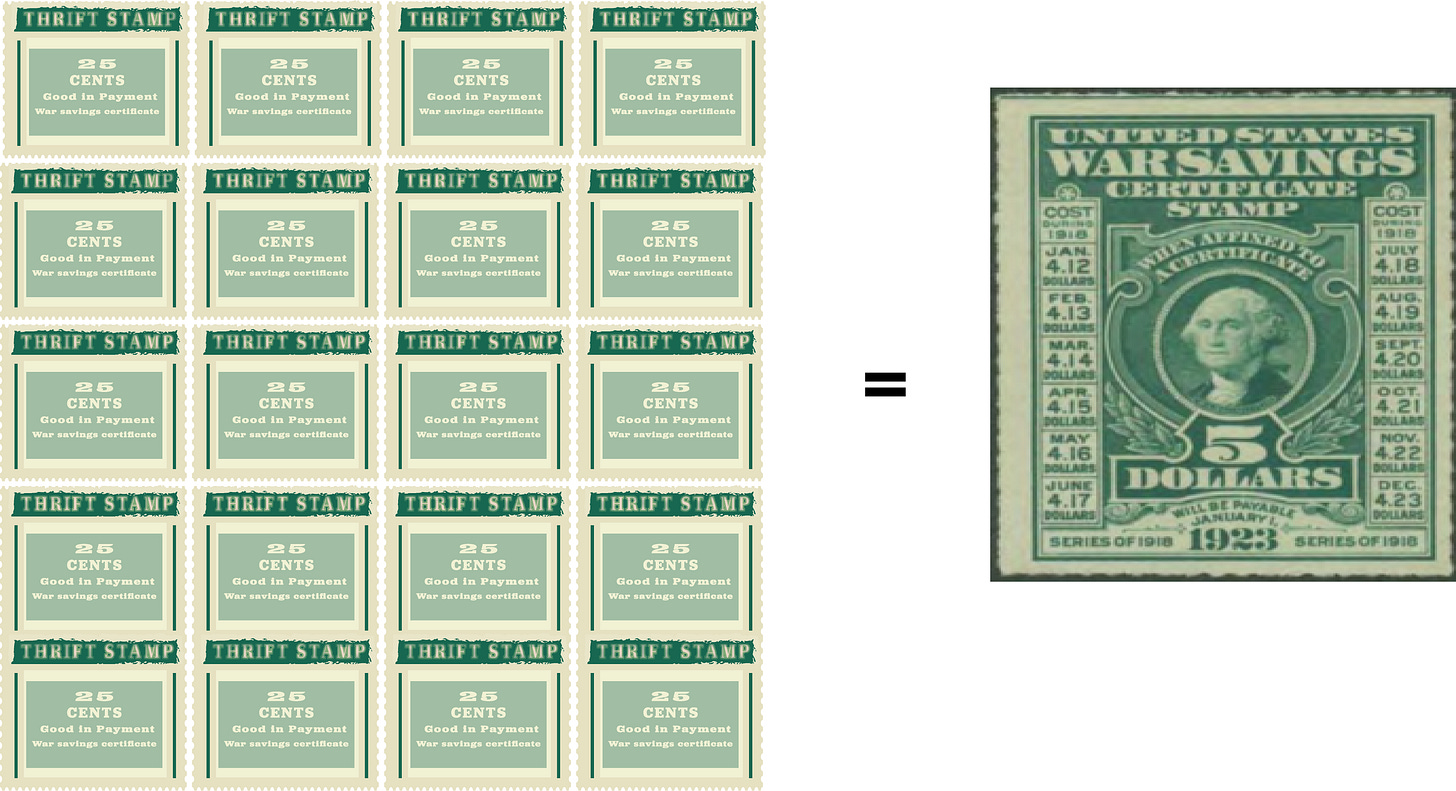

For 25 cents, the worker could purchase a thrift-stamp. The government also gave out a thrift-card to collect these thrift stamps.

After they had accumulated 16-25 thrift stamps, they could redeem it for war-savings certificate.

These war-saving certificates could then be combined to purchase a liberty bond.

Liberty bonds were redeemable by the bearer of the bonds after the maturation date. That means whoever currently possesses the bond would get the money (much like cash).

Liberty bonds offered an interest rate that was lower than the standard interest rate for depository accounts, while they were safe; people who were poor could be enticed to invest in less reliable instruments. During the war enthusiasm, many people purchased these liberty bonds as their patriotic duty.

Right after World War I, Wallstreet devised predatory marketing schemes to entice the impoverished liberty bondholders by exploiting a flaw in their design. The liberty bonds that didn't pay interest for another 15 years. Wallstreet would offer a trade. A liberty bond in exchange for corporate stock or other security. To an ordinary person, it seemed like a good deal. But, US government bonds are probably the safest investments. As long as the US government exists, we know that the person is guaranteed to receive the payments in full. Corporate stocks were riskier. The 1920s was an unregulated jungle where underwriters and corporations conspired to misinform the public. They would lie about the company's assets, total sales volumes, and sometimes about the revenue models. In this Jurassic economy, unless one was a Wallstreet insider, these stocks were hazardous.

These predatory practices would end up wiping out the savings of many, while the bankers remained relatively protected because they exchanged risky, sham corporate stock for liberty bonds that they would later redeem.

Sadly, the aggressive propaganda campaign combined with the low-interest rates created conditions for which the poorest amongst us became prey for the endless greed of Wall Street.

When the 1929 stock market crash occurred, many ordinary people who had trade liberty bonds for risky securities suffered the most.